Lithium Iron Phosphate Batteries Market

Lithium Iron Phosphate Batteries Market by Industry (Automotive, Power, Industrial, Consumer Electronics, Aerospace, Marine), Application (Portable, Stationary), Voltage (Low, Medium, High), Capacity, Design, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

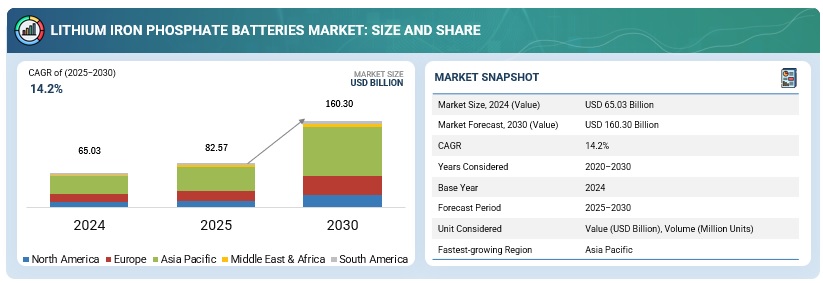

The global lithium iron phosphate batteries market is projected to reach USD 160.30 billion by 2030 from USD 82.57 billion in 2025, registering a CAGR of 14.2% during the forecast period. Lithium iron phosphate batteries are increasingly adopted over traditional lithium-ion batteries because they offer higher safety, longer lifecycle, and better thermal stability while maintaining cost-effectiveness.

KEY TAKEAWAYS

-

BY VOLTAGELFP batteries with higher voltage ratings are experiencing significant growth due to their ability to deliver greater power output and efficiency for electric vehicles and industrial machinery. Higher-voltage LFP systems enable faster charging, improved energy density, and stable performance under demanding operating conditions, making them a preferred choice for automotive and large-scale energy storage applications.

-

BY CAPACITYThe medium- and high-capacity segments are projected to register the highest CAGR during the forecast period. LFP batteries with higher capacities are increasingly adopted for electric vehicles, grid-scale energy storage, and industrial applications, offering extended runtime and reliable performance. Their ability to support large-scale operations while maintaining safety and efficiency is driving rapid adoption across transportation and stationary energy markets.

-

BY APPLICATIONBy application, the portable segment is estimated to continue to dominate market demand, driven by consumer electronics and mobility applications requiring compact, lightweight, and fast-charging solutions. LFP batteries’ high discharge rate and thermal stability make them a reliable choice for devices ranging from smartphones to electric tools.

-

BY REGIONIn Asia Pacific, efforts are underway to strengthen domestic LFP battery manufacturing and supply chains, driven by concerns over trade dependencies and the goal of supply chain resilience. Investments are being directed toward scaling production, establishing advanced manufacturing facilities, and developing critical battery components, supporting the growth of large-scale stationary energy storage solutions.

As the power and industrial sectors modernize, the potential for large-scale lithium iron phosphate (LFP) battery systems to be integrated into grid management, demand response programs, and renewable energy balancing solutions increases. Battery systems that can store, shift, or modulate energy loads provide higher operational value by improving grid stability, optimizing energy consumption, and supporting sustainable power supply.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The lithium iron phosphate batteries market is projected to grow at a compound annual growth rate (CAGR) of 14.2% during the forecast period. Leading manufacturers like BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China) Gotion (US), A123 Systems Corp (US), and CALB (China) are broadening their product and service portfolios across the entire value chain to enhance revenue opportunities. These companies have a strong diversified service portfolio and a strong geographical presence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in adoption of lithium iron phosphate batteries by EV manufacturers

-

Growing demand for battery-operated material-handling equipment in various industries and rising industrial automation

Level

-

Risks associated with disposal of spent lithium-based batteries

Level

-

Shift from conventional power systems to scalable energy storage

-

Rise in battery demand and supply expansion leading to growing investments

Level

-

Technical drawbacks related to LFP batteries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in adoption of lithium iron phosphate batteries by EV manufacturers

Electric vehicle (EV) manufacturers are increasingly opting for lithium iron phosphate (LFP) batteries due to their unique combination of safety, durability, and cost efficiency. LFP batteries are thermally stable, thus less prone to overheating or ignition, improving safety for consumers and manufacturers alike. This allows LFP batteries to perform reliably over an extended period, allowing long-term use. The recycling process of LFP is a straightforward method that does not require a certain form of waste. The use of plentiful and inexpensive materials such as iron and phosphate leads to lowered manufacturing costs, making EVs more affordable to the EV owning public. Although LFP batteries have a slightly lower energy density than batteries with nickel or cobalt, their energy density is still adequate for most daily driven ranges, without performance losses in difficult climates. Additionally, by sourcing a more secure and sustainable supply chain and materials and minimizing environmental impacts, LFP batteries have many advantages for the EV industry. All these advantages make LFP batteries particularly compelling for mass-market, urban electric vehicles.

Restraint: Risks associated with disposal of spent lithium-based batteries

Lithium-based batteries are considered hazardous waste due to their ignitability, chemical reactivity, and toxicity. They contain dangerous substances like heavy metals, acids, and flammable electrolytes, which can cause soil and water contamination if disposed of improperly. Even after being discharged, these batteries may still hold enough charge to trigger fires or explosions during handling, storage, or transportation. Unsafe disposal not only poses environmental and health risks but also leads to the loss of valuable materials that could be recovered through recycling. To mitigate these risks, batteries must be stored in secure, watertight containers, with fire suppression equipment readily available, and handled in strict compliance with government regulations governing storage, transport, and disposal. Proper recycling and treatment are crucial to ensure environmental safety, reduce pollution, and recover resources for sustainable use.

Opportunity: Rise in battery demand and supply expansion leading to growing investments

The surge in battery demand, fueled by the accelerating adoption of electric vehicles, renewable energy integration, and portable electronic devices, is driving substantial supply expansion and investment in the market. Battery manufacturers are investing heavily in new production facilities, upgrading existing plants, and exploring advanced technologies to enhance energy density, efficiency, and safety. Governments and private investors are also supporting large-scale projects to secure a reliable supply chain and reduce dependence on limited raw materials. This growing investment is not only expanding production capacity but also fostering innovation in battery chemistries, recycling technologies, and energy storage solutions, which is further accelerating the overall growth and maturity of the global battery market.

Challenge: Technical drawbacks related to LFP batteries

Lithium iron phosphate (LFP) batteries, while popular, have some technical drawbacks. Their energy density is lower compared to nickel-cobalt-aluminum (NCA) or nickel-manganese-cobalt (NMC) batteries, meaning they store less energy for the same weight or volume, which can limit driving range in electric vehicles. They also have a lower voltage, which can slightly reduce power output for certain high-performance applications. LFP batteries perform less efficiently in extremely cold temperatures, as low temperatures can reduce capacity and slow charging. These factors make them less suitable for long-range or high-power applications, even though they excel in safety, cost, and lifespan. Moreover, LFP batteries require more cells to achieve the same energy as higher-density chemistries, making battery packs bulkier and slightly heavier, which can impact vehicle design and overall efficiency.

Lithium Iron Phosphate Batteries Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A logistics operator in Germany upgraded its fleet of Linde T20 electric pallet trucks with BSLBATT's 24V LFP batteries to enhance warehouse operations. | The new LFP batteries offer rapid charging capabilities, reducing downtime and boosting energy efficiency. This upgrade also minimizes maintenance requirements and extends the lifespan of the equipment. The implementation demonstrates the advantages of adopting advanced battery technology in industrial settings. |

|

Tesla's reliance on nickel-based battery chemistries posed challenges in terms of cost, resource availability, and supply chain constraints. | Tesla initiated the integration of LFP batteries into its Standard Range Model 3 and Model Y vehicles. This transition was first implemented at the Shanghai Gigafactory, with plans to expand globally. LFP batteries, known for their abundant raw materials and cost-effectiveness, offer a promising alternative to nickel-based chemistries. Tesla's strategic shift aimed to enhance battery supply chain resilience and reduce production costs, while maintaining the performance standards expected by consumers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The lithium iron phosphate batteries market ecosystem analysis shows the interconnections/adjacencies that affect the market by showcasing MnM coverage of the market under study. The section highlights the key industries and applications impacting the market under study. The lithium iron phosphate batteries ecosystem involves key players operating across different levels. Major lithium iron phosphate battery manufacturers are BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China), Gotion (US), A123 Systems Corp (US), and CALB (China).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Lithium Iron Phosphate Batteries Market, by Industry

The automotive industry is projected to dominate the LFP battery market as EV penetration accelerates globally, with a large number of new vehicles sold by 2030 being electric. LFP is increasingly chosen by automakers for entry-level and fleet EVs because of its cost efficiency and longer cycle life. In urban mobility, where vehicles undergo frequent charging and discharging, LFP provides higher durability and lower operating costs. Bus and taxi fleets in Asia and Europe are shifting to LFP due to its strong safety profile under heavy-duty usage. Automakers such as BYD, Tesla, and Volkswagen are scaling up LFP-based models to make EVs accessible to a broader consumer base. These factors firmly position the automotive sector as the leading industry for LFP demand.

Lithium Iron Phosphate Batteries Market, by Application

The portable application segment leads because LFP batteries are widely used in power tools, eBikes, handheld medical equipment, and backup power devices. The high cycle stability of portable batteries ensures reliable performance for products that need frequent recharging, such as tablets, drones, and smart appliances. Off-grid regions are also adopting LFP in solar lanterns and portable energy storage units, where safety and durability outweigh high energy density. Rising consumer trends toward cordless and wireless devices in emerging economies further strengthen this demand. Unlike NMC, LFP’s stable chemistry reduces fire hazards in compact devices, making it ideal for household and industrial tools. The growing reliance on portable electronics worldwide cements this segment as the largest by application.

Lithium Iron Phosphate Batteries Market, by Voltage

The LFP batteries ranging 12–36V are pegged to be the dominant segment as they are widely used in electric two-wheelers, golf carts, forklifts, and low-speed EVs. These voltage levels strike a balance between energy density and safety, making them suitable for light mobility and small industrial equipment. The below 12V segment also holds a steady share due to demand in backup systems, telecom, and small power applications. Above 36V systems are rapidly growing, especially in passenger EVs and commercial vehicles that require higher performance and longer range. With the global shift toward electrification of fleets, demand for medium and high-voltage LFP batteries is expected to expand faster than low-voltage ones. This voltage diversity ensures LFP serves both mass-market and heavy-duty needs.

Lithium Iron Phosphate Batteries Market, by Capacity

LFP batteries in this range are widely used in consumer electronics, handheld medical devices, IoT sensors, and small backup systems. Their compact size, safety, and stable discharge rate make them suitable for smartphones, drones, and smart home products. Growth in wearable electronics and portable gadgets continues to fuel demand for this segment. The low risk of overheating compared to other chemistries enhances user safety, a key factor in consumer markets. As more devices transition to cordless and rechargeable formats, 0–16,250 mAh batteries will remain highly relevant. This segment serves as the foundation for LFP in the portable applications space.

REGION

North America to be the third largest market of lithium iron phosphate batteries market

The Asia Pacific lithium iron phosphate batteries market is experiencing robust growth. This is driven by rapid EV adoption, government incentives, and large-scale renewable energy storage deployment in countries such as China, India, and South Korea.

Lithium Iron Phosphate Batteries Market: COMPANY EVALUATION MATRIX

In the lithium iron phosphate batteries market matrix, BYD Company Ltd. leads with a strong market presence and wide product portfolio, driving lithium iron phosphate batteries adoption across industries like power and industrial, whereas Samsung SDI is Samsung’s battery subsidiary, focused on lithium-ion cells (for EVs, energy storage, etc.), advanced battery tech (solid-state, all-solid), cylindrical and prismatic form factors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 65.03 Billion |

| Market Forecast, 2030 (Value) | USD 160.30 Billion |

| Growth Rate | CAGR of 14.2 % from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Europe, Asia Pacific, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Lithium Iron Phosphate Batteries Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market segmentation of LFP batteries by voltage range | Developed a comprehensive global market model for LFP batteries, segmented across key voltage classes (low, medium, high), and mapped against application sectors such as EVs, ESS, and industrial mobility. Included region-wise demand patterns and adoption trends. |

|

| Technology landscape of LFP synthesis methods |

|

|

| Benchmarking of manufacturing capabilities across key players |

|

|

RECENT DEVELOPMENTS

- April 2025 : Contemporary Amperex Technology Co., Limited launched three major EV battery innovations at its first Super Tech Day: the Freevoy Dual-Power Battery, the Naxtra sodium-ion battery (world’s first mass-produced), and the second-generation Shenxing Superfast Charging LFP Battery.

- March 2024 : LITHIUMWERKS launched the AER18650, a lithium iron phosphate (LFP) cylindrical battery. It has a 1.8Ah capacity, lasts for over 2,000 full charge cycles, and is designed for industrial, medical, military, mobility, and consumer electronics.

- February 2024 : A123 Systems Corp announced a new US manufacturing facility to expand its lithium iron phosphate (LFP) battery production for automotive, commercial, and industrial uses.

- July 2023 : Gotion High-tech and BASF signed an MoU to deepen their collaboration in battery material innovation. Combining BASF’s expertise in chemical materials and Gotion’s battery technology, the partnership aimed to advance power battery materials, promote technological progress, and explore new applications to support growth in the new energy battery industry. The collaboration focused broadly on power battery materials, including components for battery packs, anode and cathode chemicals, and binders.

- November 2022 : CALB signed an agreement with Chengdu Industry Investment Group Co., Ltd., Sichuan Energy Investment Group Co., Ltd., and Sichuan Development Co., Ltd. to develop a full industry chain for lithium. CALB would cooperate with its partners to construct a high-quality new energy lithium industry, assisting Sichuan Province in creating a new energy lithium industry chain.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the lithium iron phosphate batteries market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, data triangulation was done to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

During the primary research phase, a wide range of respondents from both the supply and demand sides were interviewed to gather qualitative and quantitative insights for this report. On the supply side, participants included industry leaders such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and other senior executives from companies and organizations active in the lithium iron phosphate batteries market. The overall market engineering process employed a combination of top-down and bottom-up approaches, supplemented by multiple data triangulation techniques, to estimate and forecast the market across all defined segments and subsegments. Comprehensive qualitative and quantitative analyses were carried out to validate the findings and highlight key insights throughout the study. The following section provides a detailed breakdown of the primary respondents:

Notes: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024; Tier 1: > USD 1 billion, Tier 2: USD 500 million–1

billion, and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the lithium iron phosphate batteries market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Lithium Iron Phosphate Batteries Market : Top-Down and Bottom-Up Approach

Data Triangulation

POnce the overall market size was determined through the estimation process outlined above, it was further divided into multiple segments and subsegments. To ensure accuracy, the data triangulation technique was applied wherever relevant, enabling precise calculations for each category. The triangulation process incorporated an analysis of key factors and trends from both the demand and supply sides. Additionally, the market size was validated through the use of both top-down and bottom-up methodologies.

Market Definition

A lithium iron phosphate (LiFePO4) battery is a type of lithium-ion battery that charges and discharges at high speed. It uses lithium iron phosphate as the cathode and graphite as the anode. The battery delivers a constant voltage and has a higher charge cycle. The charge cycle is 2,000–3,000 per battery; these properties differentiate it from other lithium-ion batteries. Low cost, natural abundance of iron, safety characteristics, nontoxicity, excellent thermal stability, better electrochemical performance, and high specific capacity are the other properties that have helped lithium iron phosphate batteries gain considerable market acceptance. Improvements in coating and the usage of nanoscale phosphate have made these batteries more efficient.

The market for lithium iron phosphate batteries is defined as the sum of revenues generated by global companies through the sales of their lithium iron phosphate batteries. The scope of the current study includes the bifurcation of this market by design, capacity, industry, application, voltage, and region.

Stakeholders

- Lithium iron phosphate battery manufacturers and providers

- Electric vehicle (EV) manufacturing companies

- Lithium-ion battery manufacturers & providers

- R&D laboratories

- Energy & power sector consulting companies

- Distributors of lithium iron phosphate batteries

- Government and research organizations

- State and national regulatory authorities

Report Objectives

- To define, describe, segment, and forecast the lithium iron phosphate batteries market based on capacity, industry, application, voltage, and region, in terms of value

- To forecast the market sizes for five major regions, namely North America, Europe, Asia Pacific, South America, the Middle East & Africa, along with their key countries, in terms of value

- To provide information on the design of lithium iron phosphate batteries

- To forecast the lithium iron phosphate batteries market by industry and region, in terms of volume

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the lithium iron phosphate batteries market

- To provide the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences & events, the impact of AI/Gen AI, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, and regulatory analysis, the impact of the 2025 US tariffs on the market

- To analyze opportunities for stakeholders in the lithium iron phosphate batteries market and draw a competitive landscape of the market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study

- To benchmark market players using the company evaluation quadrant, which analyzes market players on the broad categories of business and product strategies adopted by them

- To compare key market players with respect to product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, product launches, partnerships, joint ventures & collaborations, in the lithium iron phosphate batteries market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the lithium iron phosphate batteries by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Lithium Iron Phosphate Batteries Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Lithium Iron Phosphate Batteries Market

Khumalo

Jul, 2022

For Lithium Iron Phosphate Batteries Market, Marketsandmarkets have profiled top 20 players in terms of their business overview, financial analysis of last 3 years, product offered, new product launched, recent developments including Mergers & Acquisitions and SWOT analysis. Chapter 10 covers the market share analysis for these players and the recent developments took place since 2018 till 2021 for instance in product launches, deals and Partnerships % Collaborations of these companies. Contents of Interim: 1) Market Overview 2) Competitive Landscape (WIP) 3) Company Profiles (WIP) 4) Appendix. For each key player, Marketsandmarkets will provide their manufacturing process, by location (world-wide) and inform which type of production methodology they adopted (i.e., ) Phosphoric acid(wet process & elemental phosphorus process), or Ammonium Dihydrogenphosphate, or Iron Phosphate or Precursor or LFP battery..